4 big reasons an organisation must manage fleet risk

InsightsArticle3 June 2019

Our employees are our best asset—yet, they’re also the biggest cause of vehicle crashes. Around 94 per cent of these are caused by human error*, with fatigue and driver distraction the two biggest issues leading to motoring incidents.

Ironically, the safer our vehicles become, the less safe we act on the road.

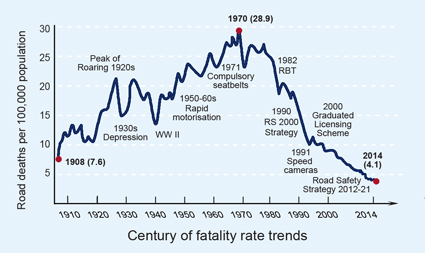

While vehicle manufacturers have introduced a number of impressive safety features over the years, research shows that these developments can cocoon drivers into believing that nothing can go wrong. When mandatory seat belts were first introduced in New South Wales in 1971, the fatality rate went up**. When speed cameras were introduced in 1991, again, the road fatality rate increased the following year. This happens because people feel ‘safer’ and take on greater risks - a phenomenon that often happens when new safety measures are introduced.

We still report nearly 1100 road-related deaths in Australia each year, or three fatalities every day - the equivalent of four Airbus A330s falling out of the sky each year.

If we had this number of fatalities in the airline industry each year, we would never accept it. The government would change legislation to make the skies safer; there would be tighter controls on staff, on manufacturing and on maintenance. The fallout of this kind of fatality record would have an enormous cost on consumer travel and could seriously impact the industry’s viability, including the Airlines’ ability to continue operating.

However, when the same number of people die on the road we don’t seem to take action. We shrug our shoulders and simply accept that is a consequence of travelling by road.

Whether a company’s focus is to protect its people, protect their property or protect their profits, it is possible to manage your fleet in an effective way and achieve your strategic imperatives.

There are four main reasons why organisations should do this:

1. To minimise risk of harm

The last thing any organisation wants to do is put their employees or a member of the public in a position that is unsafe. No one goes to work thinking ‘I’m going to hurt someone today’; whether the business we’re in is small or large, we all have an ethical urge to minimise risk of harm to our people and others.

2. Strategic compliance

There are a wide range of rules and regulations governing how we use our vehicles and what they should be fitted with, in terms of optimal safety. For a company to manage their fleet risk well they must ensure they meet legislative compliance as the bare minimum. Absolute legal compliance should be the base from which you work to ideally exceed safety regulations where possible.

3. Corporate and social responsibility

Both as individuals and as organisations we have a duty of care to other road users and to society in general. But what are the wider impacts to society if you’re not taking care of motor fleet risks and your organisation is reporting a high frequency of crashes? Having insurance in place does not necessarily provide full financial restitution. The impact on other people, their vehicles, their businesses, damage to the roads and infrastructure such as safety barriers (that have to be repaired by road agencies), and all of the congestion and subsequent delays created as a result? The impact on hospital and emergency services - all paid from the taxpayer’s purse? By minimising harm and meeting your corporate and social responsibilities, it has a positive impact on reducing the cost to society and the taxpayers within it.

4. Minimising financial loss

Managing fleet risks is essential in order to minimise losses, protect your profits and increase profit margins. As already mentioned, not everything is covered by an insurance policy; most come with an excess, and it can be a significant cost for large corporations. For instance, additional costs not covered by an insurance policy could include absenteeism; even relatively minor injuries can result in a couple of days off work. Furthermore, heavy plant, trucks, cars, sedans and commercial vehicles represent a significant amount of assets. These vehicles are a major part of an organisation’s supply chain, which achieves the ultimate goal of generating income, and making a profit. So when a vehicle is off the road being repaired following a crash, it still has to be paid for, and yet its not participating in turnover and profit generation.

There are many other costs of vehicle crashes. At Zurich we use a very conservative ‘times three’ factor. For every $1 paid in an insurance claim, there could be $3 in indirect, additional costs. By taking greater care of your drivers and their vehicles to optimally manage your fleet risk, you stand to gain stronger sustainably of your business and ultimately, improved profitability.

*Source: National Highway Traffic Safety Administration study: Critical Reasons for Crashes Investigated in the National Motor Vehicle Crash Causation Survey: https://www.nhtsa.gov/press-releases/usdot-releases-2016-fatal-traffic-crash-data

**Source: https://roadsafety.transport.nsw.gov.au/statistics/fatalitytrends.html